- Bitcoin prices have risen by more than 12% in the past seven days.

- Indicators suggest that BTC may turn bearish even before retesting its ATH.

Bitcoin [BTC] Having broken through the psychological resistance at $60,000, the price is finally on the road to recovery, and the rise in price suggests a retest of the all-time highs is likely in the coming days.

However, the coin witnessed a massive increase in liquidations shortly after the ATH and would face obstacles.

Will Bitcoin Retest Its All-Time Highs?

CoinMarketCap data Last week, we saw a double-digit increase in the price of BTC. To be precise, the king of cryptocurrencies has experienced a 12% price increase in the past seven days.

In the past 24 hours alone, the coin’s price has surged by over 4%. At the time of writing, BTC is trading at $62,543.73, with a market cap of over $1.23 trillion.

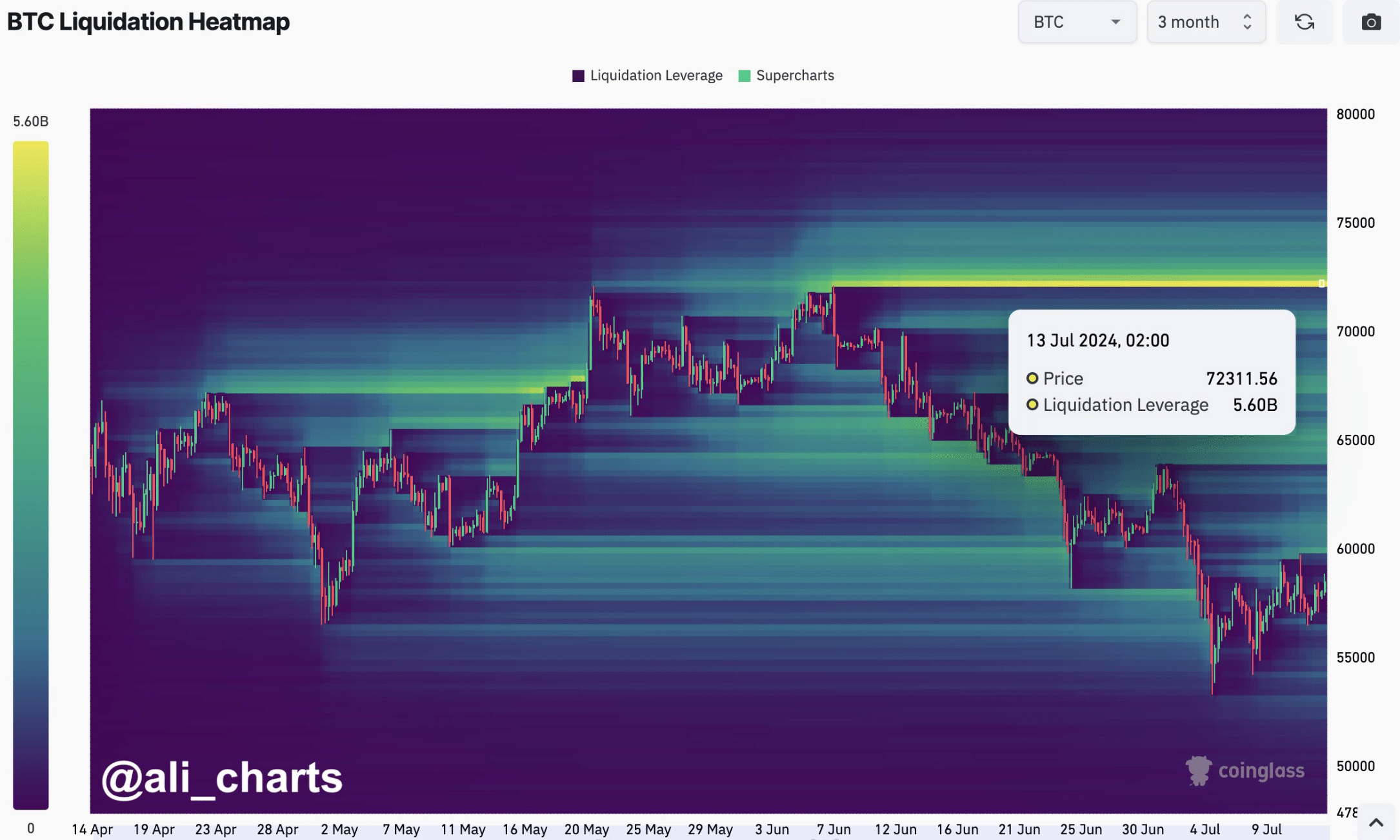

Meanwhile, Ali, a popular crypto analyst, Tweet Highlighting an important development: According to the tweet, if Bitcoin were to reverse to $72,300, $5.6 billion in short positions would be liquidated.

This suggests that BTC is likely to witness a price correction after reaching $72.3k.

Increased liquidations typically result in a short-term price correction, so investors may see BTC retest its all-time highs in the coming weeks before slowing or plummeting for a few days.

The Road to $72,000 BTC

With the possibility of BTC experiencing a price correction at $72,000, AMBCrypto planned to check the indicators to see if there are any other hurdles before that mark.

AMBCrypto Analysis of CryptoQuant data It revealed that Bitcoin exchange reserves are increasing, increasing selling pressure.

aSORP was in the red, which clearly suggests that more investors are taking profits and selling. If we are in the midst of a bull market, this could signal a market peak.

Additionally, NULP revealed that investors are currently in a conviction phase where they are sitting on high unrealized gains.

At the time of writing, the BTC Fear and Greed Index is reading 69%, indicating that the market is in the “fear” stage. When this indicator hits that level, it suggests a possible price correction.

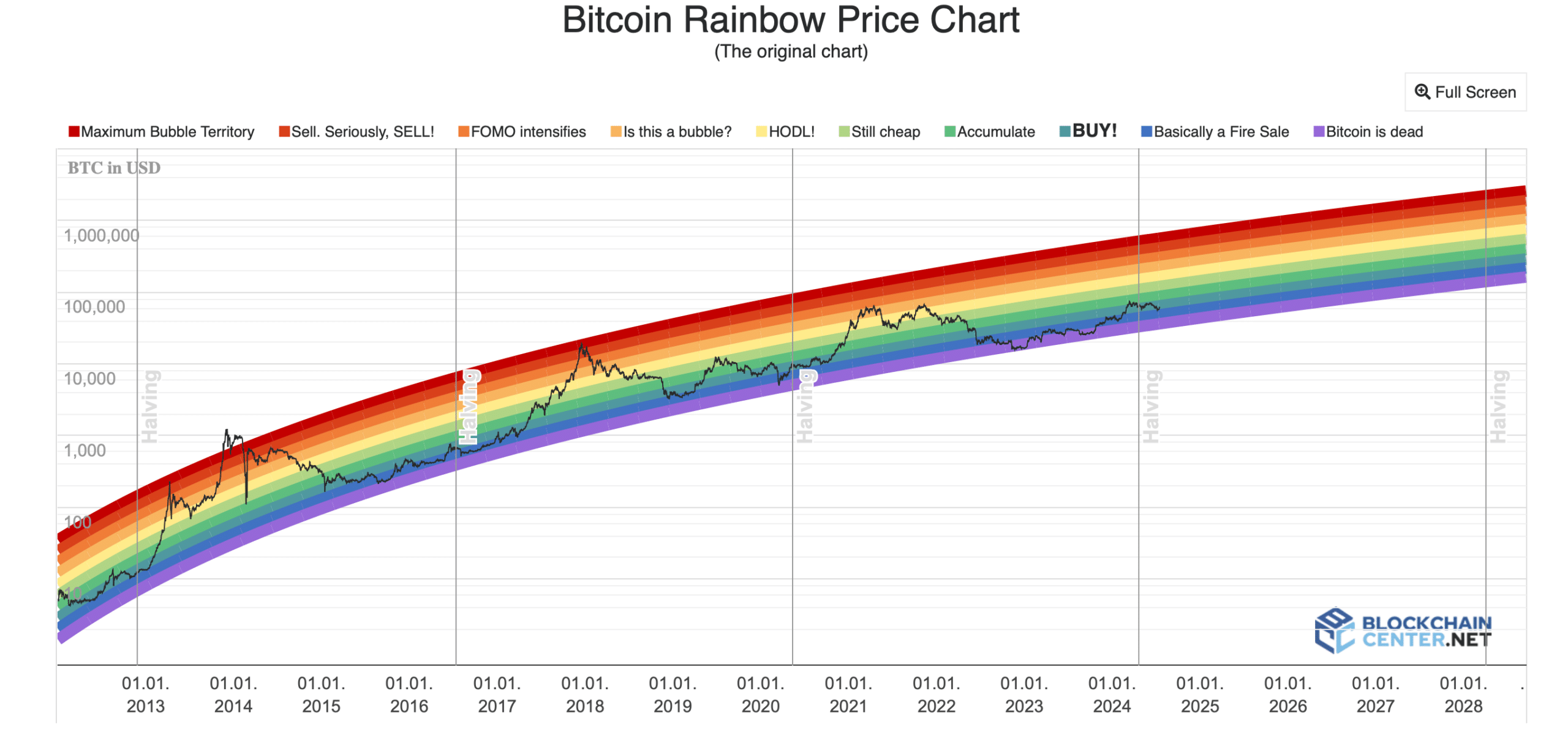

However, Bitcoin’s rainbow chart showed a buy signal. According to the indicator, BTC is in a “buying” phase, which means there is still time for investors to accumulate BTC before it hits new highs.

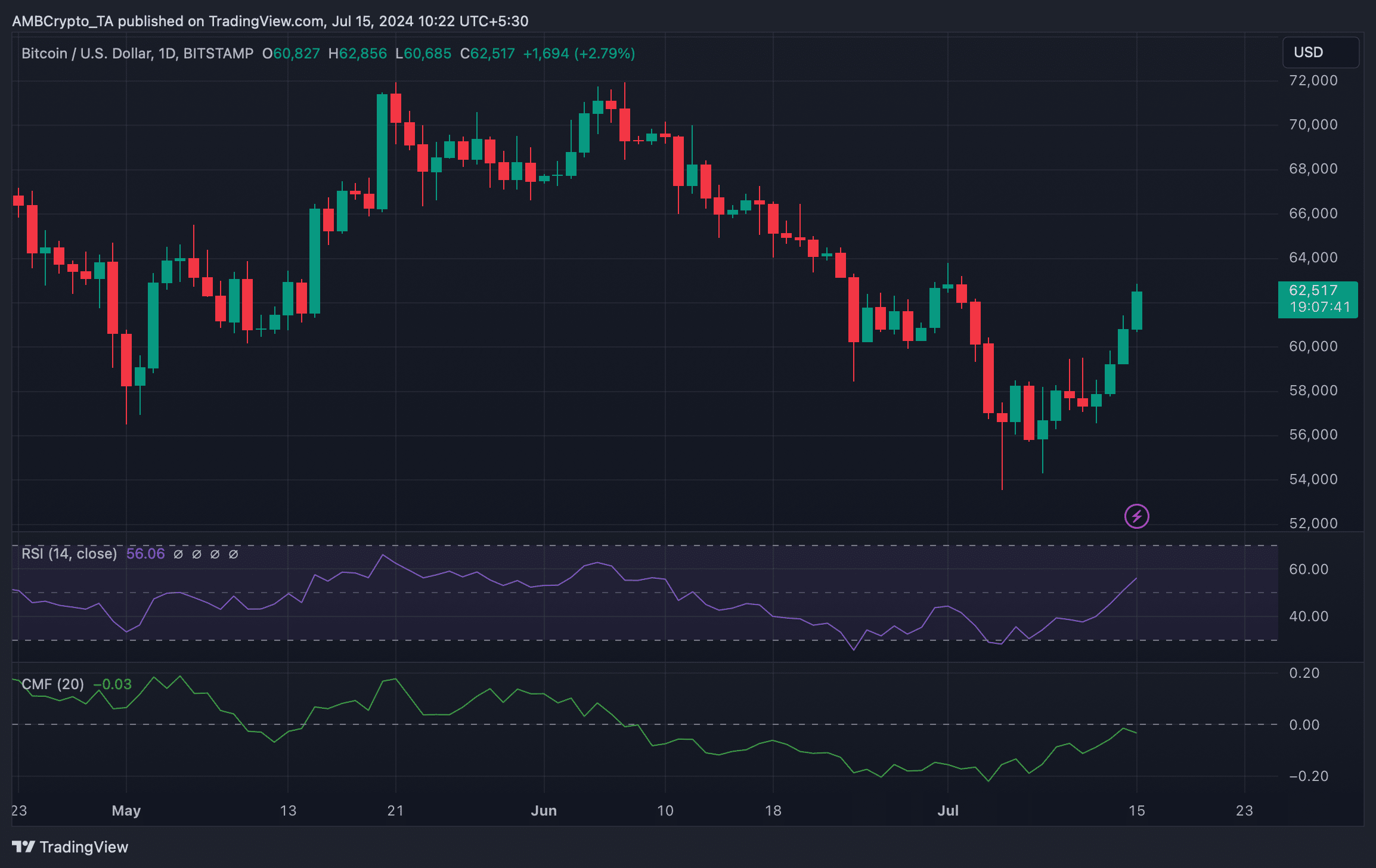

We then planned to take a look at the daily chart of the coin to get a better understanding of whether a correction is expected before resuming its path towards $72,000.

read Bitcoin (BTC) Price Prediction 2024-25

We have noticed that Chaikin Money Flow (CMF) has fallen, signalling a price correction.

Nevertheless, the Relative Strength Index (RSI) remained bullish as it rose further from the neutral levels.