- Bitcoin fell nearly 3% after rising to a local high of $69,400.

- Bitcoin dominance and liquidity charts give clues about the next price movement.

Bitcoin [BTC] The $69,000 resistance zone has been reached. In our previous reports, we had stated that the liquidity pool at this level was likely Attractive price Check it out before a potential bearish reversal.

In the last 24 hours of trading, BTC hit $69.4k, down 2.7%, and is trading at $67.5k at the time of writing. Metrics The short-term outlook was bearish earlier this week, and Monday’s trading session could dictate the trend for next week.

Potential Scenarios for Bitcoin This Week

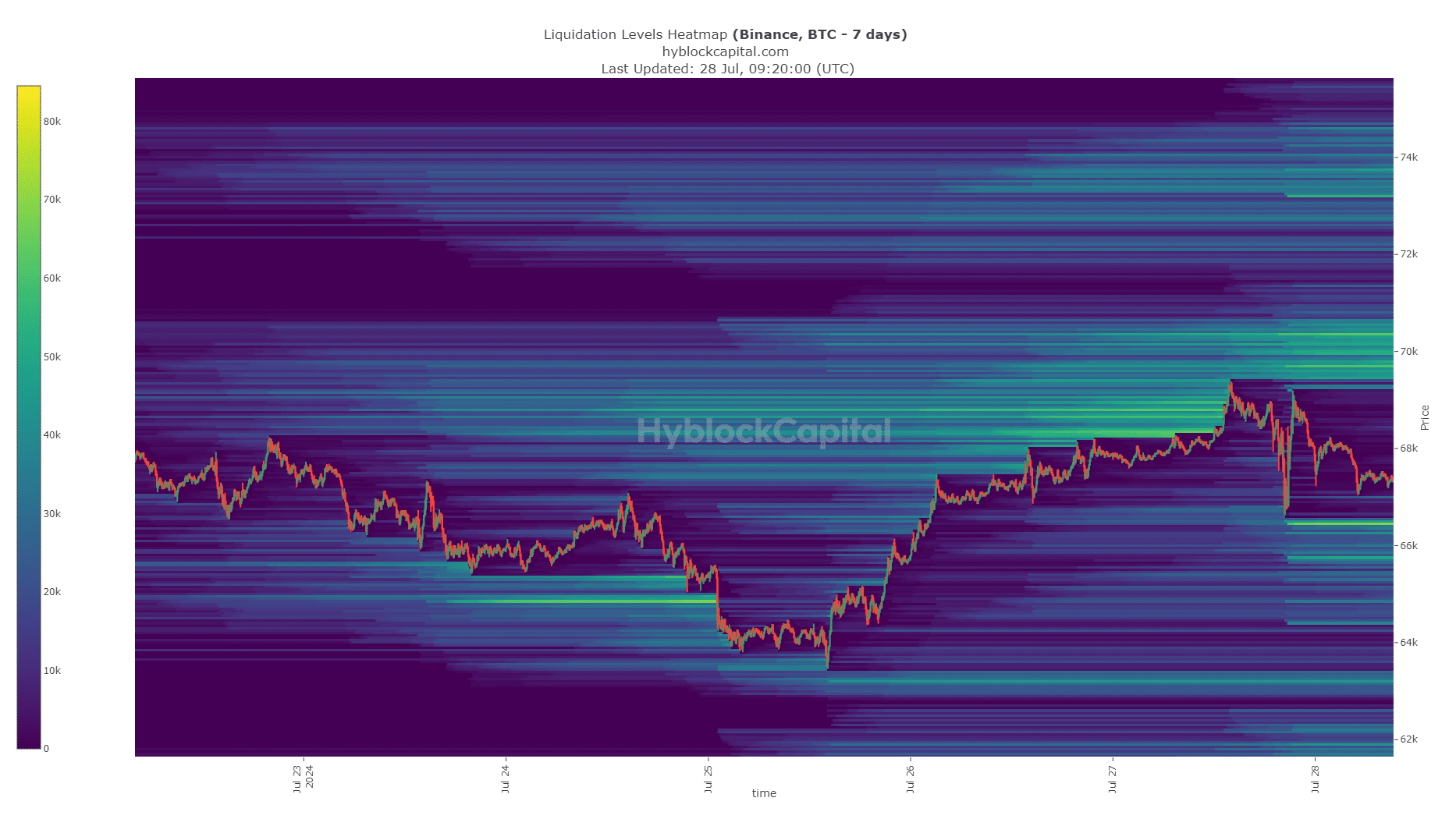

sauce: High Block

AMBCrypto analyzed a seven-day lookback period of the liquidation heatmap. Clusters of liquidation levels existed around the $70,000 and $66,400 levels.

Over the past few hours, the price reversal from the $69,000 zone has increased the liquidity pool by approximately $70,000.

This makes Bitcoin’s price objective for Monday an interesting one, with a move towards the $70,000 area to mop up liquidity and generate hope among bulls before a reversal occurs.

This price rise could precede a drop to the $66.4k level. A move above either level could be an indication of whether the week will be bullish or bearish.

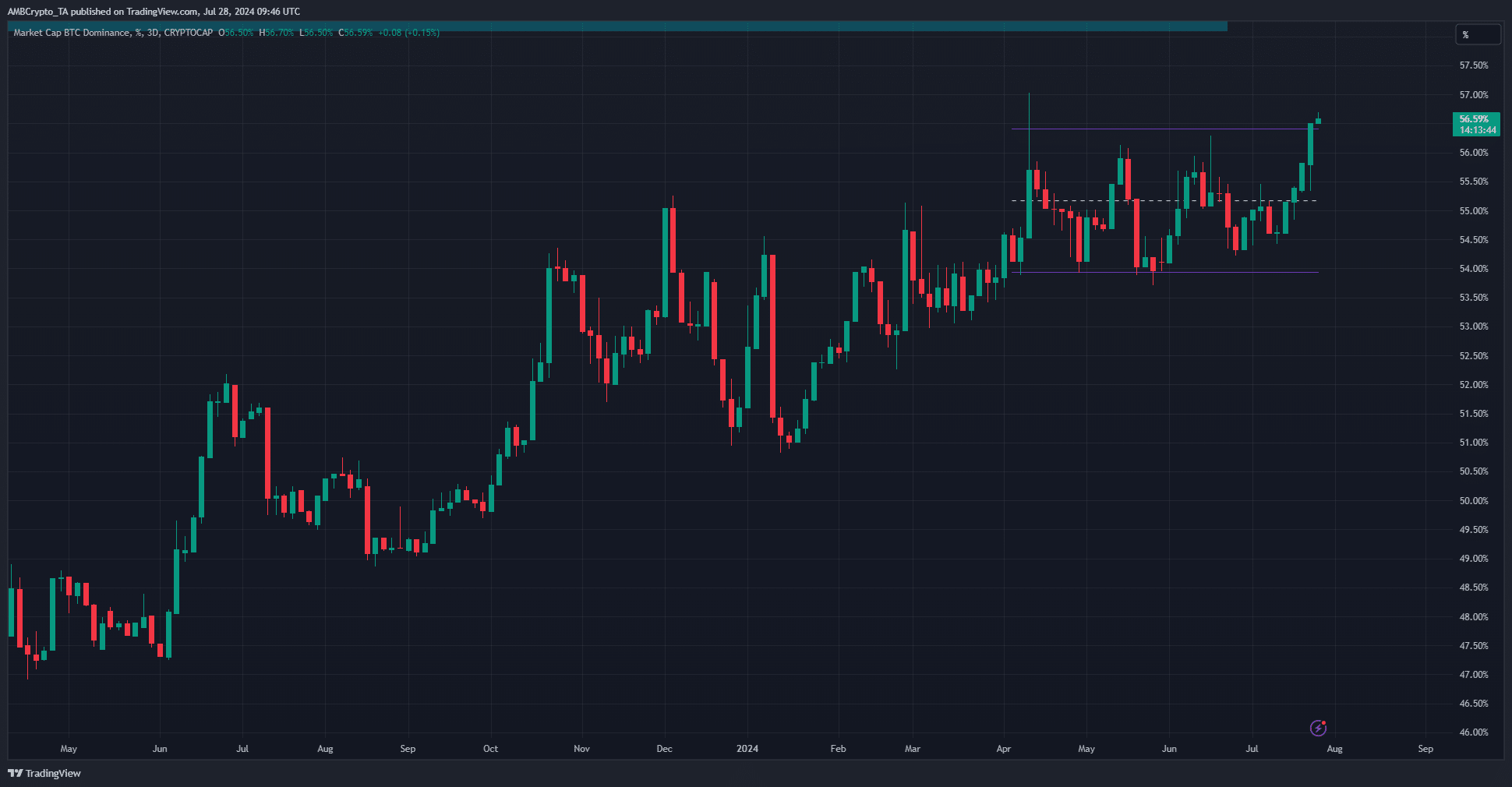

Tips from the Dominance Chart

The Bitcoin dominance chart shows a breakout above the high of the range, meaning Bitcoin is outperforming major altcoins, which would be disproportionately hit if the overall market were to tank.

Traders can use this information to decide which assets to trade based on Monday’s directional clues.

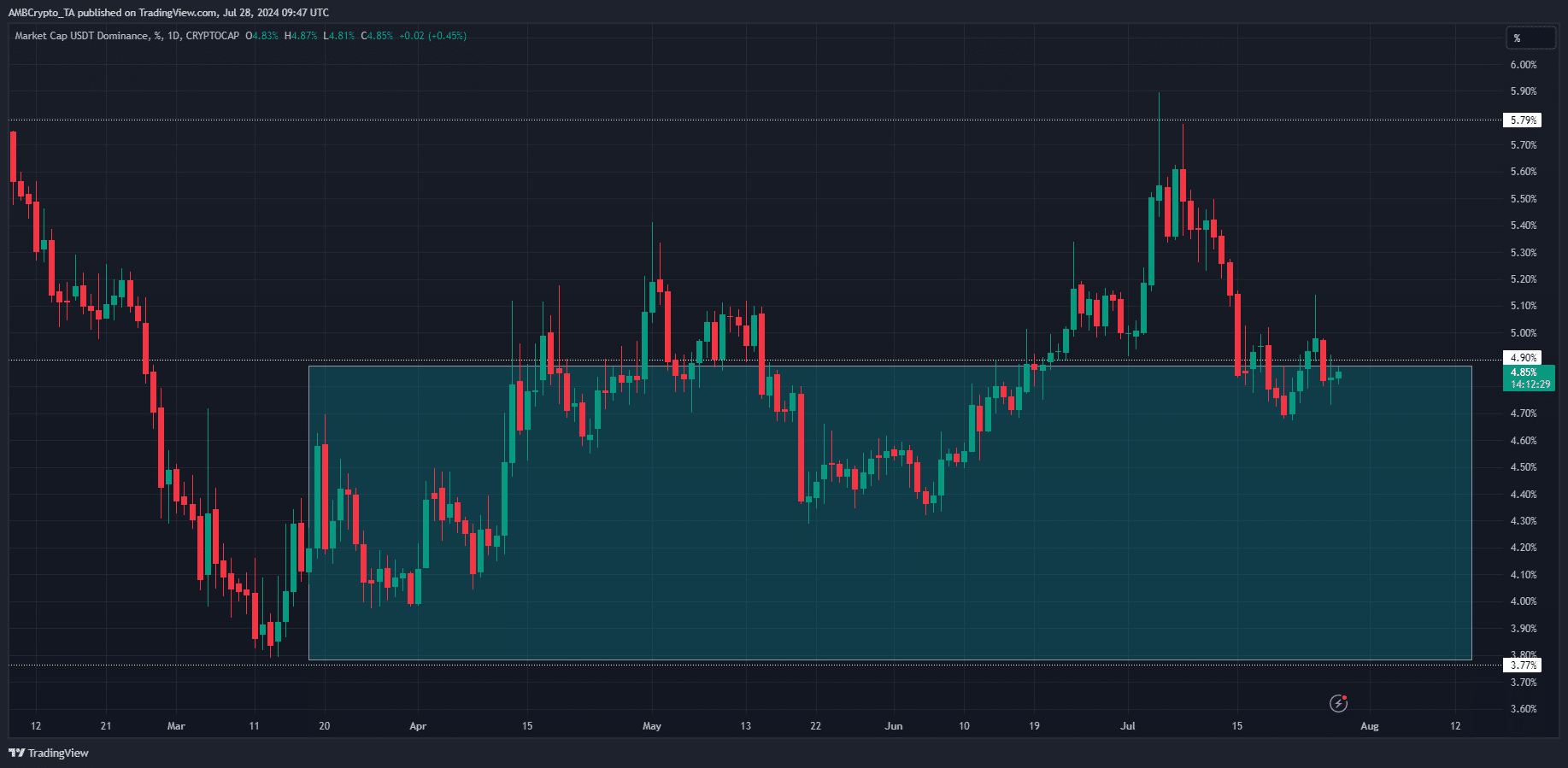

The Tether Dominance chart has an inverse relationship with the price fluctuations in the cryptocurrency market. When USDT.D rises, it is a sign that investors are moving into stablecoins and selling cryptocurrencies.

read Bitcoin [BTC] Price Prediction 2024-25

Based on Tether’s dominance trend, a drop is likely this week. Traders can closely watch Monday’s performance and build their directional bias accordingly.

Over the past month, USDT.D’s movements on Mondays have largely dictated its direction for the following week.