Dow Jones Industrial Average futures were up slightly late Sunday, while S&P 500 futures and Nasdaq futures were up slightly after President Joe Biden ended his campaign rally. Tesla (TSLA), Google’s parent company alphabet (Google), Service Now (now) and GE Aerospace (GE) will spark a barrage of earnings reports next week.

↑

X

Big tech stocks hit as Tesla, Google report earnings

President Biden withdraws from 2024 presidential race

President Biden will “step down” After weeks of growing concern following his disastrous defeat in last month’s presidential debate, Biden said in a statement Sunday that he was removing himself from the race in 2024. Biden endorsed Vice President Kamala Harris, saying he “fully supports and endorses Kamala to be our party’s nominee.” Other Democrats, including rival candidates, have also endorsed Harris.

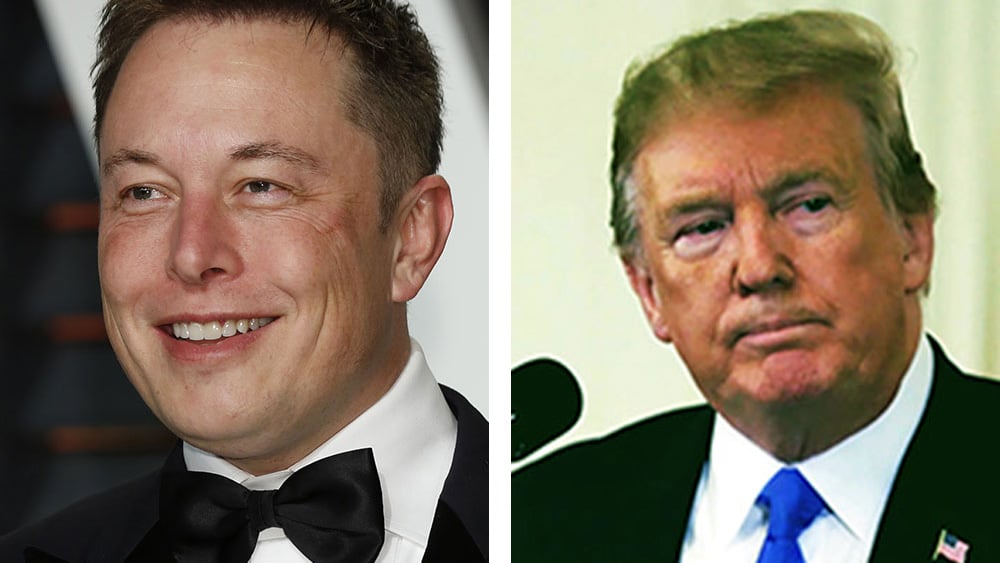

A Biden withdrawal could roil financial markets, which have increasingly priced former President Donald Trump back into the White House. While Trump remains favored over Harris, Biden’s withdrawal makes that much less certain.

Dow Jones Futures Today

Dow Jones futures were trading slightly above fair value, S&P 500 futures rose 0.1% and Nasdaq 100 futures rose 0.2%.

The yield on the 10-year Treasury note fell to 4.23%. Crude oil futures rose slightly.

Following Biden’s departure from office, Bitcoin briefly fell to $65,850, but is now trading above $68,000 and up slightly.

The People’s Bank of China cut its seven-day reverse repurchase rate by 10 basis points to 1.7% and China’s state-owned banks followed suit, lowering their one-year and five-year lending rates by 10 basis points to 3.35% and 3.85%, respectively.

Remember, you were in action all night. Dow Futures and other territories are not necessarily reflected in the next regular transaction. Stock Market session.

Stock market enters recession

The stock market rally shifted to the Dow Jones Industrial Average, small caps and various non-tech sectors, before turning broadly back by Friday.

The Nasdaq fell and the S&P 500 retreated due to the semiconductor industry’s slump. Crowdstrike (CRWD) IT outages etc. NVIDIA (NVDA) and many other leader stocks were also sold off.

Increased Revenue

Google, ServiceNow and GE aren’t far behind in the investments, as are Tesla shares, which fell sharply on Friday after former President Donald Trump, who is backed by Elon Musk, promised to roll back EV policies.

Google and ServiceNow’s earnings reports will be important for the technology sector, which includes artificial intelligence, cloud computing, online advertising and business software.

This week is shaping up to be a big earnings week, with Tesla, Google, ServiceNow and GE joining the ranks. App Folio (Australia), United Rental (URI), KLA Corporation (crack), Tenet Healthcare (THC), and also reports trading in petroleum machinery. Weatherford (WFRD) and Technip FMC (FTI). And there are hundreds more.

IBD experts break down major stocks and markets on IBD Live.

Stock market rise

The stock market rally got off to a strong start this week, especially outside of the Nasdaq, but Nvidia and semiconductor stocks fell broadly on Wednesday, and the weakness extended into the second half of the week.

The Dow Jones Industrial Average rose 0.7% last week. Stock Market Tradingbut fell to near weekly lows after hitting a record intraday high on Thursday. The small-cap Russell 2000 rose 1.7%, but was still well off Wednesday’s multi-year high.

After hitting a record high on Tuesday, the S&P 500 index fell 2% to drop below its 21-day line.

The Nasdaq fell 3.65%, well below its 21-day average. On July 10, it was 8.9% above its 50-day moving average, but is now just 1.7% above its 50-day moving average.

Invesco S&P 500 Equal Weight ETF (RSP) fell 0.1% after hitting a record high during trading hours on Thursday.

First Trust Nasdaq 100 Equal Weight Index ETF (Wow) fell 2.4% after hitting an all-time high on Tuesday, testing its 50-day line. While better than the Nasdaq 100’s 4% drop, the QQEW’s decline shows that the sharp decline in tech growth stocks isn’t just limited to large caps.

The CBOE Volatility Index (VIX) rose nearly 33% to 16.53, its biggest weekly gain since March 2023. Still, the market’s fear gauge remains well below its peaks in April (21.36) and October 2023 (23.08).

The yield on the 10-year Treasury note rose 5 basis points to 4.24% after hitting a four-month low on Wednesday.

U.S. crude futures fell 2.5% on Friday to $80.13 a barrel, down 3.25%.

Copper futures plunged 8.25%, their worst week in two years. A fall in “Doctor Copper” doesn’t bode well for the global economy.

Coinbase issues buy signal, leads top 5 stocks to watch

ETF

Among growth ETFs, the Innovator IBD 50 ETF (50 …) fell 4.7% last week. The iShares Expanded Tech-Software Sector ETF (IGV), which is a major holding in ServiceNow and also has CrowdStrike as a member, fell 2.8%.SMH) fell 9.6%, with Nvidia shares being its largest component.

Reflecting more speculative story stocks, the ARK Innovation ETF (arc) fell 0.4% last week, while the ARK Genomics ETF (arc) rose 0.2%. Tesla shares are the No. 1 holding in the Ark Invest ETF.

SPDR S&P Metals & Mining ETF (XME) fell 2.4% last week. The Global X U.S. Infrastructure Development ETF (Pavé) rose just 0.35%.Jets) fell 0.7%. The SPDR S&P Home Builders ETF (translation) rose 3.25%.XL) rose 2.05%, while the Health Care Select Sector SPDR Fund (Chapter 45) fell 0.25%. The Industrial Select Sector SPDR Fund (Article 41) rose 0.55%, but was near its weekly low.

Financial Select SPDR ETF (XLF) rose 1.2%, while the SPDR S&P Regional Banking ETF (Clé) rose 7.5%.

Timing the Market with IBD’s ETF Market Strategy

Tesla stock

Tesla fell 4% on Friday, closing at $239.20, its lowest since July 2. However, the stock is still trading above its 21-day moving average. On a weekly basis, TSLA shares fell a relatively modest 3.6%, but still show positive movement after a big rally in the previous week of trading. Tesla has a buy point of 271 with corrections going back several months to a year.

During his Republican nomination speech Thursday night, former President Donald Trump pledged to repeal the de facto national EV mandate. Repealing the mandate would likely reduce competition and favor Tesla, but California and other Democratic-leaning states have their own EV mandates. Repealing the mandate would also reduce Tesla’s EV credit revenues. Meanwhile, Trump has previously said he supports eliminating EV subsidies, which would likely hurt Tesla.

Additionally, President Trump has said he wants Chinese EV makers to build factories in the United States, which would be a big shift from President Biden’s position. BYD (BYDDF) rose 1.7% to 31.06 on Friday, re-establishing a buy point at 30.84.

Musk is a strong supporter of Trump and has donated millions of dollars to pro-Trump super PACs.

Trump said Saturday that he read that Elon Musk pays him $45 million a month, and that “we have to make life better for people like him.”

Tesla reports earnings on Tuesday night, with profits likely to fall sharply but revenues likely to rise slightly, and the focus, as always, will be on a conference call with Musk discussing deliveries, future models, and a variety of ambitious plans.

Tesla shares fall ahead of earnings release on Trump’s comments, BYD in buy zone

Nvidia stock

Nvidia fell 8.75% this week to 117.93, its lowest level since early June. The AI chip giant closed above its 50-day moving average but just below its 10-week moving average. Nvidia shares may be in a double bottom base, but they need more time.

A decisive drop in Nvidia’s stock price would be a major negative for the tech industry.

What to do now

The Nasdaq is struggling and other parts of the market are starting to fall as well. Now doesn’t seem like a good time to make new purchases, especially with profits surging. By taking quick stop losses, you can reduce your overall exposure.

The silver lining is that tech stocks are no longer at perfect levels heading into the middle of earnings season, which increases the opportunity for a big upside reaction, but also a big earnings crash along the way.

Now is definitely the time to get proactive and get prepared, which means keeping your watchlists and game plans up to date this weekend and paying attention come Monday morning.

Nvidia’s stock price IBD Leaderboard And that IBD50Google’s stock price IBD Big Cap 20.

read The Big Picture We work daily to stay in sync with market trends, leading stocks and sectors.

Follow Ed Carson on Threads Follow and X/Twitter translator Stock market updates and more.

You might also like:

Why this IBD tool simplifies bakech Top Stocks

Get the next big stock hit with MarketSurge

Want to make quick profits and avoid big losses? Try SwingTrader

Best growth stocks to buy and watch

IBD Digital: Get IBD’s premium stock lists, tools, and analysis now