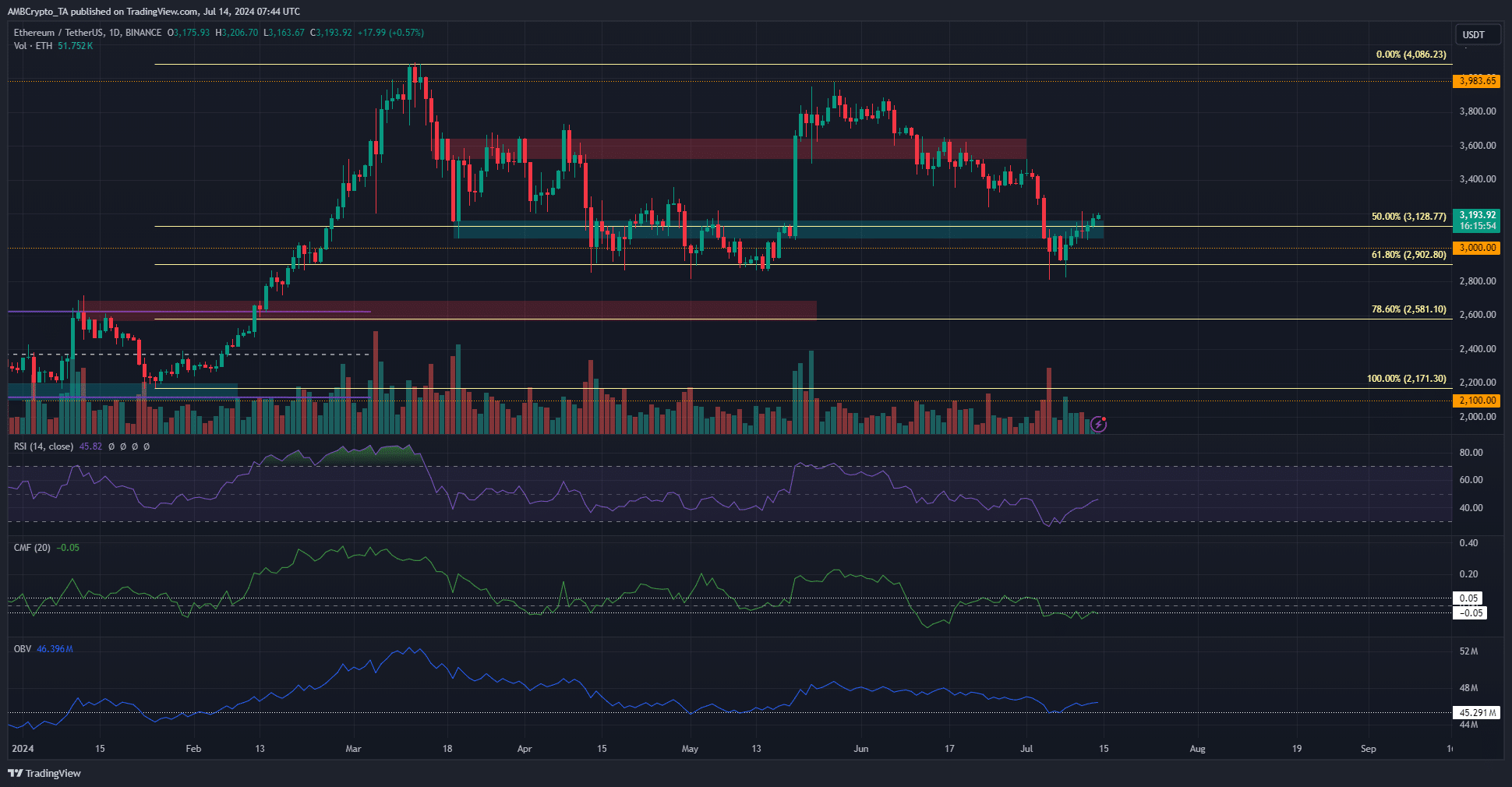

- Ethereum is exhibiting a bearish market structure on the daily chart but is still targeting the next key resistance zone.

- Trading volume has been below average in recent days, so prices may fall next week.

Ethereum [ETH] Having risen above the $3,000 levels once again, the previous resistance zone at $3,100 has flipped into support in an interesting development for the bulls.

of Tightrope walking A comparison of whale deposits with foreign exchange reserves shows that recent deposits are tiny compared to outflows over the past two months.

Ethereum network Gas prices It hit a May low and shows a decline in network activity, which is not a good sign and reflects reduced on-chain demand and slower growth.

Despite the breakout, volume indicators remain ambiguous

On Saturday, July 13, Ethereum broke through the resistance zone near $3,100 and ended the day’s trading at $3,201. Despite this achievement, market structure and momentum were bearish on the daily time frame.

Moreover, the CMF is showing -0.05, suggesting significant capital outflow from the market. The OBV failed to start an uptrend due to stagnant buying volume in the past 10 days, which means that buying volume is too weak to be taken as a clear signal of bullish strength.

The daily RSI was indicating bearish momentum at 45 but has been trending up over the past week. As things stand, Ethereum may not be able to handle a sharp upswing unless more volumes flow into the market.

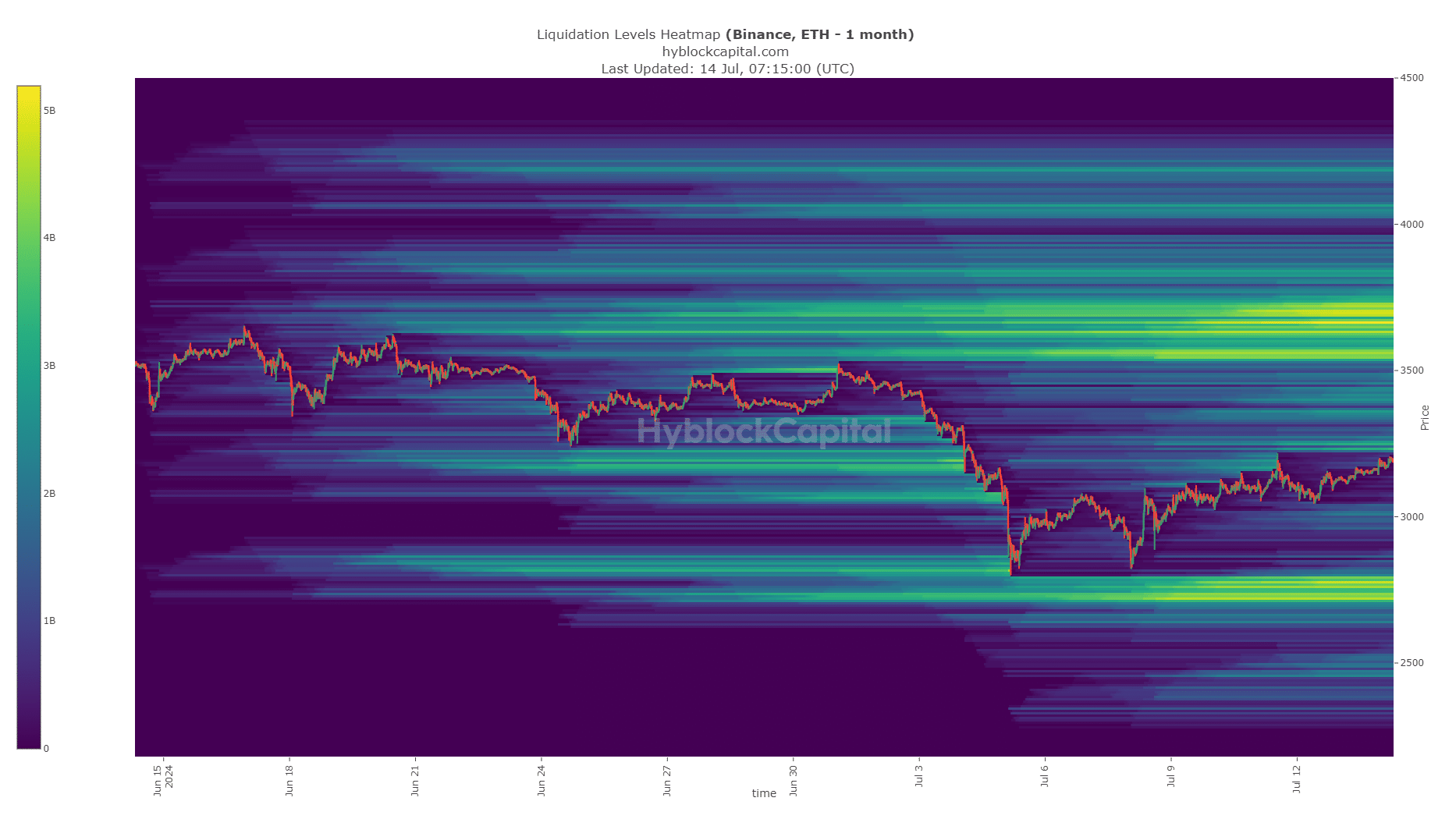

Liquidation heatmap points to next resistance

sauce: High Block

The 2.7k-2.8k zone to the south was an attractive liquidity pool that was tested in the first week of July but never fully conquered.

The subsequent price rally above $3.1k suggests that the next liquidity cluster at $3.5k to $3.7k is a target for bulls.

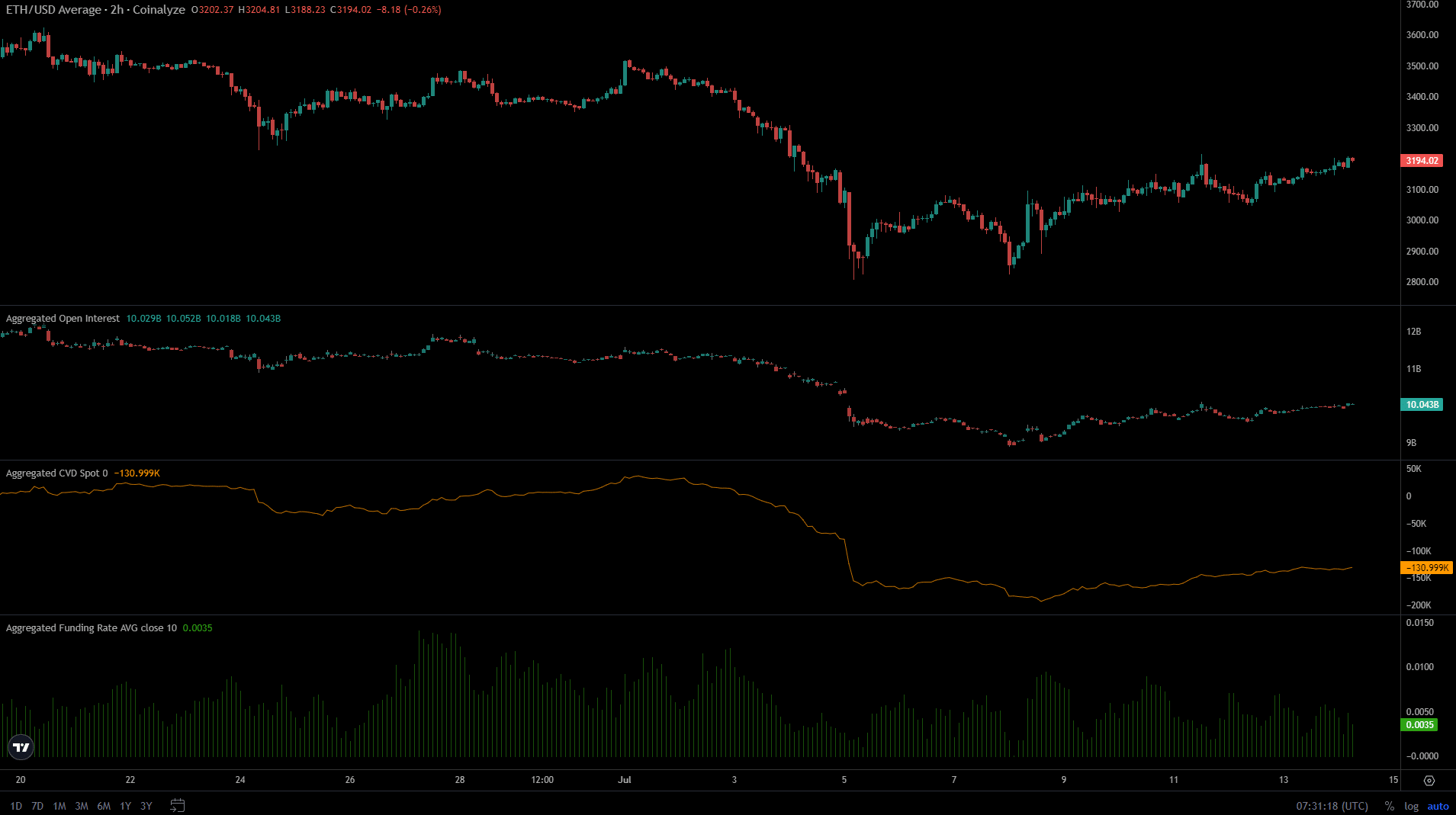

sauce: Coin Alize

Is your portfolio green? Ethereum Profit Calculator

Open interest was rising along with price, funding rates were positive, sentiment was strong and bullish, and spot CVD was also recovering.

If this trend holds, the chances of ETH rising towards $3.6k will increase.

Disclaimer: The information presented does not constitute financial, investment, trading or any other type of advice and consists solely of the opinions of the authors.