(Bloomberg) — Gold prices steadied after hitting fresh records as traders increased bets that the Federal Reserve will cut interest rates while factoring in an uncertain U.S. political outlook.

Most read articles on Bloomberg

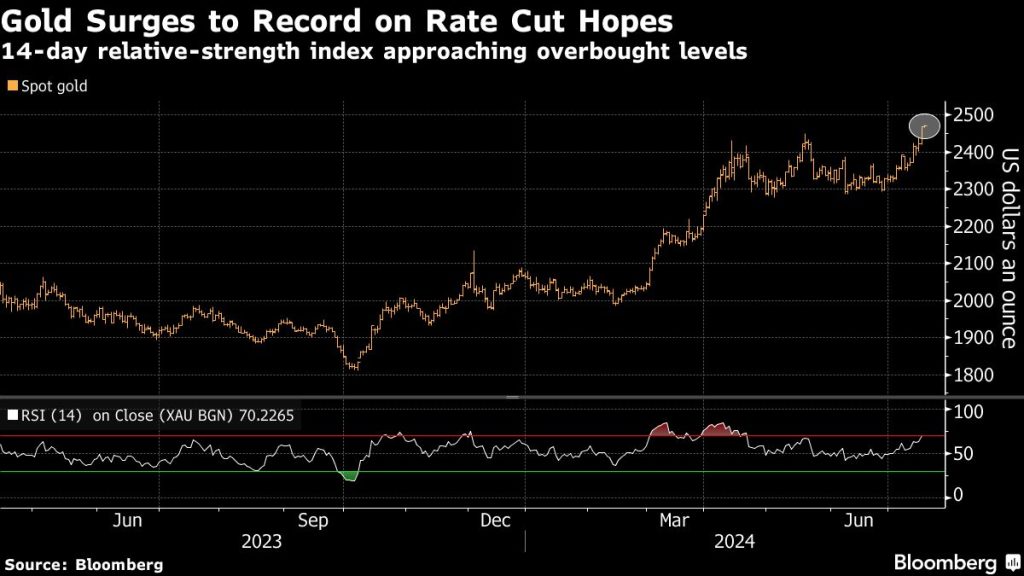

Gold prices rose to an all-time high of $2,483.73 an ounce on Wednesday before paring gains. Gold prices rose 1.9% on Tuesday, surpassing the all-time high hit in May, as traders bet on an early, bigger interest rate cut from the Fed amid growing signs that inflation is slowing toward the central bank’s target. Precious metals, which don’t earn interest, tend to favor lower borrowing costs.

Federal Reserve Chairman Christopher Waller said Wednesday that the economy is nearing a point where the central bank can lower borrowing costs, but he wants “a little more evidence” that inflation is on a sustained downward trend. Waller is among a growing number of officials who have signaled they are close to cutting interest rates, though most, including Chairman Jerome Powell, have offered only guidance on exactly when that might happen.

Gold has surged nearly 20% this year, buoyed by heavy central bank purchases, robust Chinese consumer demand and safe haven demand amid geopolitical tensions. As the bull market continues, momentum-driven investors are once again emerging as the metal’s main drivers.

“Fundamentals have clearly shifted, giving investors more reason to rebalance their gold holdings in their portfolios, which is leading price-sensitive funds to chase the rally,” Chris Weston, head of research at Pepperstone Group, said in a note on Wednesday. “Given the broad range of positioning and the lack of extremes in sentiment, $2,500 could be tested soon.”

Still, there are signs the rally may be overdone: Gold’s 14-day relative strength index is hovering around 70, which some investors consider to be overbought.

Meanwhile, markets continue to assess the financial and political ramifications of the weekend assassination attempt on Donald Trump as the presidential race gathers momentum. A return of Trump to the White House could bolster gold’s safe-haven status if global trade tensions escalate.

As of 11:10 a.m. New York time, spot gold prices were down 0.3% to $2,461.56. The Bloomberg Dollar Spot Index was down 0.2%, while the 10-year Treasury yield rose slightly. Silver, platinum and palladium were lower.

–With assistance from William Clowes.

Most read articles on Bloomberg Businessweek

©2024 Bloomberg LP