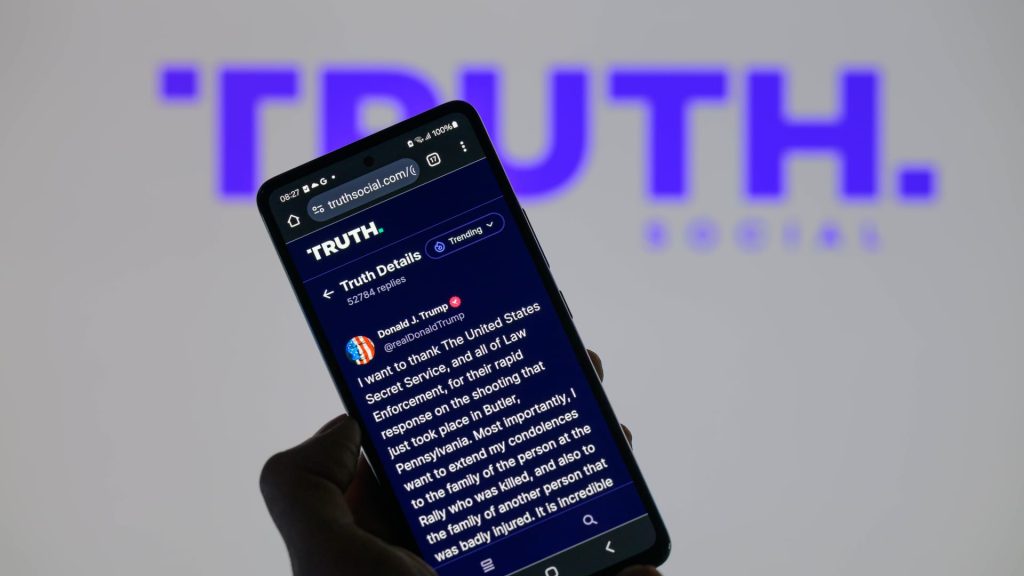

Before the bell rings, let’s check out the companies that are making waves. Trump Media & Technology – Shares of Truth Social’s parent company surged more than 50% following Saturday’s assassination attempt on former President Donald Trump. Some argue that the assassination attempt will increase Trump’s chances of winning the November election. Apple – Apple shares rose 2%. Loop Capital raised its rating on the tech giant to “buy” and said upcoming AI integrations will create an opportunity for the iPhone maker to become the “base camp” of choice for generative AI. Bloomberg News also reported that the company’s India sales rose 33% year-over-year to $8 billion through March. Supermicro Computer – Shares of Supermicro Computer, which makes graphics processing unit servers, rose 3.6% before the July 22 open in the Nasdaq 100 index after the company announced it would replace pharmacy chain Walgreens Boots Alliance.Goldman Sachs – Shares fell less than 1% after the bank beat expectations for second-quarter profit. Goldman posted earnings per share of $8.62 on revenue of $12.73 billion, while analysts surveyed by LSEG had expected earnings per share of $8.34 on revenue of $12.46 billion. Crypto Stocks – Bitcoin miners and crypto stocks rose as bitcoin and ethereum surged more than 4%. Coinbase rose about 5%, followed by Marathon Digital, CleanSpark and Riot Platforms. SolarEdge Technologies – Solar stocks fell about 9% after the company announced plans to lay off 400 employees in an effort to restore profitability amid declining revenue. Other solar stocks fell, with Sunrun and Sunnova Energy each down more than 6%. NextEra Energy fell 2%. Cleveland-Cliffs — The steelmaker’s shares fell 3.5% after it said it would buy Canadian steelmaker Stelco Holdings for C$3.4 billion (about $2.5 billion). Tesla — The electric-vehicle stock rose 4%, following a rise of more than 25% so far this month. AutoNation — Shares in auto retailer AutoNation fell less than 1% after the company said it expects a hit to second-quarter profit as a result of a cyber incident with CDK Global, a third-party provider of information systems. BlackRock — Shares rose 1.2%. The world’s largest asset manager reported second-quarter adjusted earnings per share of $10.36, beating LSEG’s consensus estimate of $9.93. But revenue of $4.81 billion fell short of expectations of $4.85 billion. Baxter International — The investment firm said Baxter has limited room to rise, even as it trades at its lowest level in nearly a decade. —CNBC’s Lisa Han, Hakyung Kim, Sarah Min, Jesse Pound and Pia Shin contributed to this report.

Trending

- Anxiety in teenagers linked to sugary drinks – new research

- This 20-Minute Morning Ritual Can Boost Your Energy for the Entire Day—and It’s So Easy

- Expertise Protects Against Cognitive Decline

- Eating 3 tablespoons of peanut butter per day could have key benefit

- Hospitals Fighting Measles Confront a Challenge: Few Doctors Have Seen It Before

- Moderna’s 2-in-1 flu and COVID vaccine shows encouraging results in small trial

- Obstructive sleep apnoea costs UK and US economies £137bn a year, research finds | Sleep apnoea

- Dentists still write millions of prescriptions a year for an antibiotic with life-threatening risks

Wednesday, February 25