(Bloomberg) — Woodside Energy Group Inc. agreed to buy Tellurian Corp. for about $900 million, a struggling U.S. developer of liquefied natural gas (LNG) export projects, betting on rapidly growing global demand for the fuel.

Most read articles on Bloomberg

Australia’s largest oil and gas producer said on Monday it will pay about $1 per share in cash to acquire full control of Tellurian, including the Driftwood LNG project on the U.S. Gulf Coast. Woodside shares fell 2.1% in Sydney after the news was released, their biggest one-day drop since May 1. Tellurian shares were up more than 65% in New York premarket trading on Monday morning.

Woodside has been one of the most vocal energy companies saying more gas will be needed to make up for the expansion of intermittent renewable energy sources.The company has been exploring possible U.S. LNG investments that could help expand its supply portfolio, and Driftwood is one of the few companies unaffected by President Joe Biden’s suspension of approvals in January.

“The acquisition of Tellurian and its Driftwood LNG development opportunity will position Woodside as a leading global LNG player,” said Woodside CEO Meg O’Neill. “Our complementary position in the U.S. will enable us to better serve customers around the world and further capture marketing optimization opportunities in both the Atlantic and Pacific regions.”

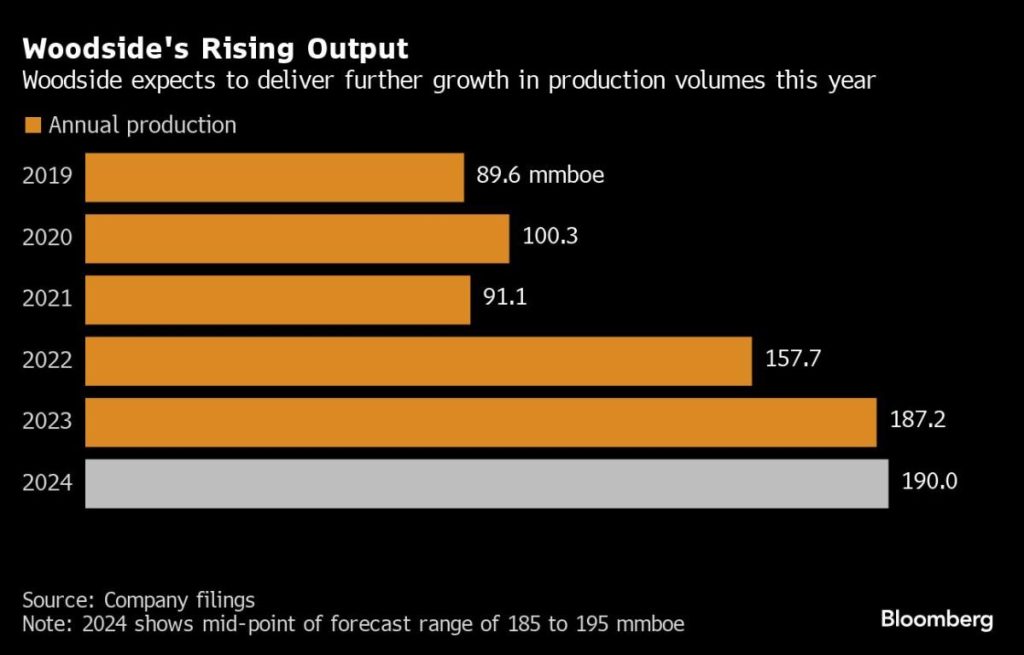

Woodside aims to make a final investment decision on the first phase of the Driftwood project starting in the first quarter of 2025. Once all four phases are complete, the Louisiana facility will be able to export 27.6 million tonnes per year, nearly triple Woodside’s current production capacity and about 6% of the global total at the end of last year.

Tellurian has struggled to get the facility off the ground since LNG pioneer Sharif Souki founded the company in 2016. Souki left the company in December amid his own bankruptcy proceedings. Tellurian co-founder and current chairman, industry veteran Martin Houston, has vowed to cut costs, and there have long been talks of selling the business.

“Woodside’s involvement with Driftwood brings a great deal of certainty to the project,” Houston said in an interview.

Driftwood differs from other U.S. LNG projects in that it signed long-term contracts linked to spot prices in Asia and Europe, exposing importers to volatile spot markets and ultimately causing Tellurian to lose out on several potential deals, including with major Indian customers Shell and Vitol.

Woodside “can get the project underway better than Tellurian can,” said Saul Kavonic, an energy analyst at Sydney-based MST Marquee, adding that the Australian company “can fill in the gaps in marketing relationships, capital and operational capabilities. This is the deal Woodside should be making – a deal where Woodside can come in cheaply and add value.”

U.S. private equity gas driller Ason Energy has signed a non-binding agreement to buy LNG from the Driftwood project after acquiring Tellurian’s upstream gas assets earlier this year. President Gordon Huddleston said in an interview that the company looks forward to working with Woodside.

Woodside has been exploring opportunities to expand exports. Earlier this year it ended talks with smaller rival Santos SA that would have made it the biggest LNG producer in Asia-Pacific. The company said in a presentation that it is inviting potential partners for its Driftwood project and aims to sell about 50 percent of it.

O’Neill said on a conference call with analysts that the company has already expressed interest in collaborating on U.S. LNG. The deal is expected to close in the fourth quarter.

–With assistance from Rob Verdonck and Elizabeth Elkin.

(Updates stock prices in second paragraph)

Most read articles on Bloomberg Businessweek

©2024 Bloomberg LP