$1.3 trillion came and went in less than a month and people didn’t even notice. Amazing.

by Wolf Richter for Wolf Street.

The week was marked by a continued sell-off in tech stocks and a wilting of the much-touted “rotation” into smaller caps. The S&P 500 fell 2.0%, the Nasdaq Composite fell 3.6%, the Nasdaq 100 fell 4.0% and the Magnificent 7 fell 4.7%.

However, the Russell 2000, which tracks about 2,000 small-cap stocks, surged 5.3% in the first two days of the week as part of a “rotation” into smaller caps, before falling 3.5% over the remaining three days of the week, and ending the week up 1.7%, back to February 2021 levels.

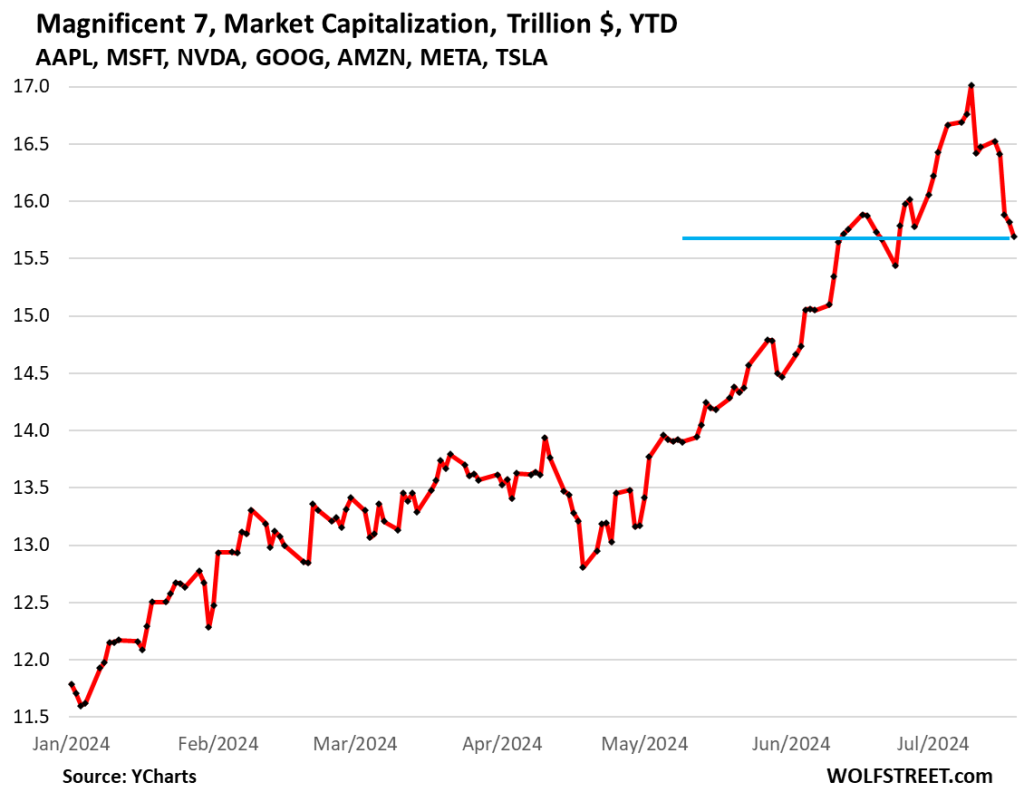

Mag7 On Friday, market cap fell another $113 billion, bringing the total decline from the July 10 peak to $1.32 trillion (-7.7%). That $1.32 trillion moved in and out of just over a month, across seven stocks, and went almost unnoticed. That’s pretty astonishing when you think about it; it was a significant amount of money at one time.

The combined market capitalization of the seven companies has now fallen to $15.69 trillion, down from over $17 trillion on July 10. The market capitalization of the seven major companies is back to where it was on June 13. This $1.32 trillion drop is still well above the dollar drop in April (-$1.13 trillion), but the 7.7% drop is still below the 8.1% drop in April.

Mag 7 individual stocks down from their July 10th peaks (Nvidia rebounded on Thursday but fell again on Friday).

- apple [AAPL]: -3.6% (-$129 billion)

- Microsoft [MSFT]: -6.3% (-$217 billion)

- alphabet [GOOG]: -6.9% (-$164 billion)

- Amazon [AMZN]: -8.3% (-$173 billion)

- Tesla [TSLA]: -9.2% (-$78 billion)

- Meta [META]: -10.8% (-146 billion dollars)

- NVIDIA [NVDA]: -12.3% (-410 billion dollars).

Looking at percentages over the past 12 months, two of the Mag 7s stand out.

- Nvidia is still up 150% over the past 12 months, even with the recent drop (red line in the chart below).

- Tesla is still down 18% over the 12-month period and 42% from its all-time high in February 2021 (green).

The remaining five companies’ 12-month gains are smaller than Nvidia’s 150% gain, but they’re still high despite their recent declines.

- Meta: +50.9%

- Alphabet: +46.1%

- Amazon: +35.3%

- Microsoft: +23.1%

- Apple: +15.0%.

Small Cap On Wednesday, July 17th, after a sudden burst of glory when it seemed like the whole market was “floating” on them or something, they collapsed.

The Russell 2000 surged 11.5% over the five trading days from July 9 to July 16. The index began to decline on Wednesday, closing 3.5% down on Friday from Tuesday’s high, but a 5.3% surge in the first two days of the week meant the index was still up 1.7% for the week overall.

The Russell 2000 was at 2,184, back to the levels seen in February 2021. Such sudden spikes and falls certainly do nothing to ease our fears.

Nasdaq 100 IndexThe index, which tracks the 100 largest nonfinancial stocks listed on the Nasdaq and is dominated by big technology and social media companies, fell 4.0% for the week and is down 5.6% from its peak on July 10.

The index is up 16% so far this year despite two sell-offs, the first of which in April ended with a 6.2% drop.

The index is still up 51.5% since the start of 2021, with some big troughs along the way, and has surged 88% since the trough in December 2022. This dizzying run to higher heights has done nothing to ease our fears.

S&P 500 Index Stocks are only just beginning to feel the first effects of the tech drama. So far, the declines have been modest: The index is down 2% this week and is down 2.9% from Tuesday’s high.

The index has surged 47% since the start of 2021. Since the bottom in October 2022, the index has surged 53%. These are sharp gains on top of already sky-high valuations, with almost zero declines to date.

Enjoy reading WOLF STREET and want to support us? You can donate, we’d be so grateful! Click on Beer and Iced Tea Mugs to find out how.

Would you like to be notified by email when WOLF STREET publishes a new article? Register here.

![]()